"BOXABL and FG Merger II Corp. Sign Merger Agreement to Pursue a BOXABL Public Listing on NASDAQ"

From Crowdfunded → NASDAQ

The Boxabl Case Study

How Early Retail Investors Turned $1,000 into $80K+ and What It Teaches You About Picking the Next Winner!

©️ By Yvan De Munck, aka RegCFRocket

📷Executive Snapshot

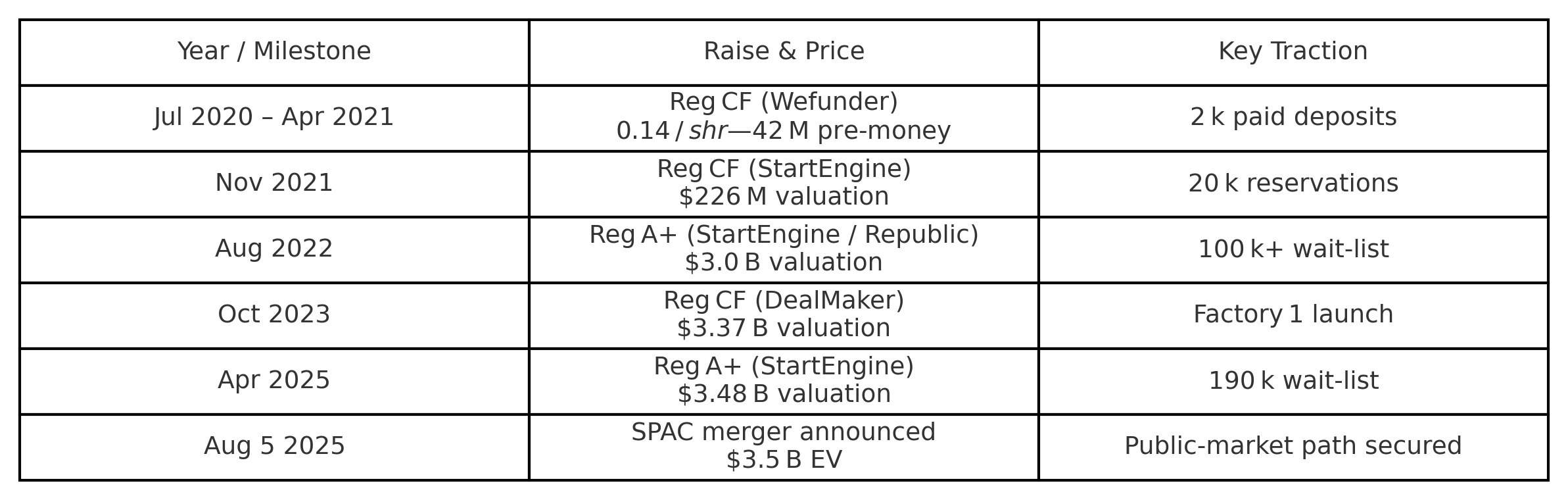

Deal: Boxabl to merge with SPAC FG Merger II at a $3.5 billion enterprise value; shares will trade on Nasdaq under BXBL.

Crowdfunding Path: Boxabl has raised $230 m+ from roughly 50,000 investors across Reg CF and Reg A+ rounds since 2020.

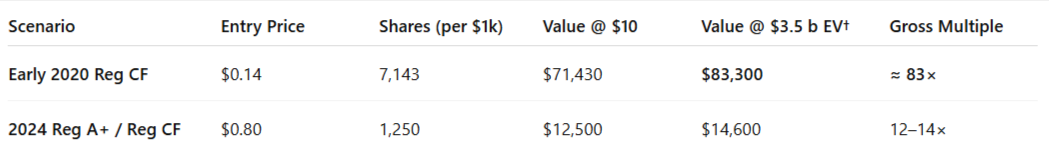

Early-to-Public Upside:

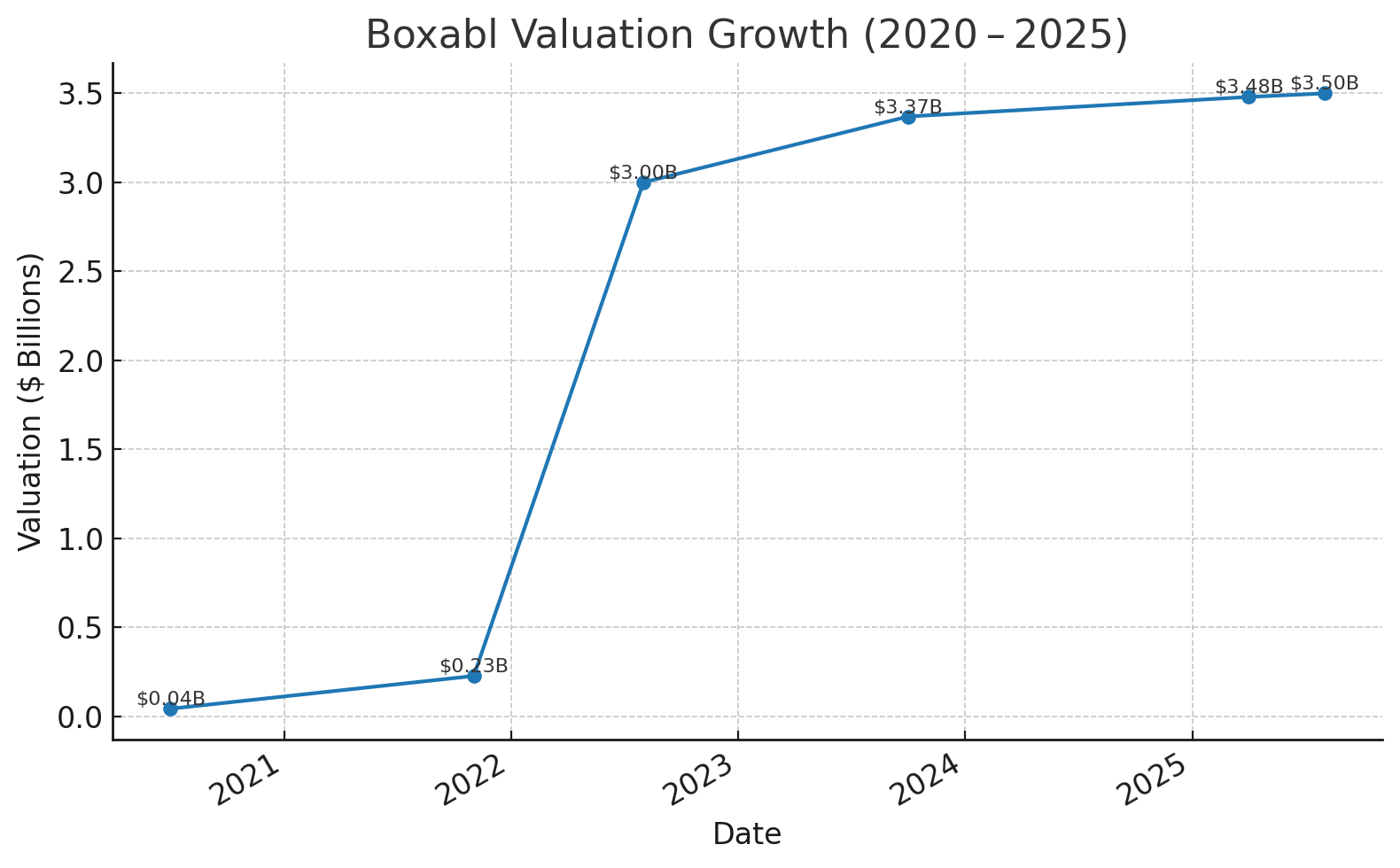

EV basis: $3.5 b ÷ $42 m entry = ≈ 83× paper lift for 2020 investors.

Share-price basis: $10 SPAC baseline ÷ $0.14 = ≈ 71×.

Late-round ($0.80) investors still stare at ≈ 12–14× depending on final float.

➡️Boxabl Timeline

👩🔬Investor Math (Illustrative)

†EV method scales original $42 m valuation to $3.5B; actual share price post-SPAC will vary with redemptions, dilution, and market sentiment.

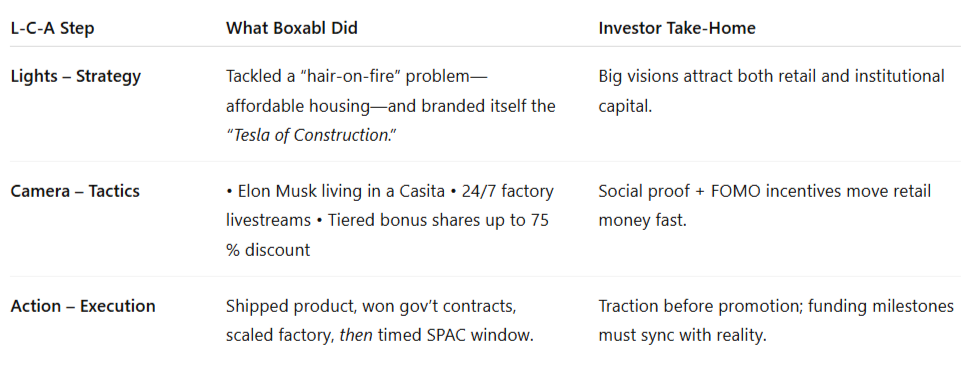

🤔Why Boxabl Smashed It (L-C-A System style)

📌How to Spot the Next Boxabl

Rapid Raisers: >$1 m in weeks = organic demand.

50× Headroom: Entry valuations below $50 m leave room for >80× exits.

Value Trajectory: Each new round ≥ 2× prior valuation → institutional heat.

Platform / Factory Moat: Hard-to-copy unit economics.

Exit Visibility: M&A chatter, Reg A Tier 2 filings, or SPAC rumors.

👉Get all that and more by checking out the Capital Pulse Ratings List here.

🛝Your Playbook

Build a Watch-List: Filter CClear ratings for raise speed / valuation.

Deploy the “10-Ticket Rule”: Ten $1–2 k bets beat one moon-shot.

Run L-C-A Diagnostics: If any step flunks, pass.

Keep Dry Powder: Hold 30 % cash for follow-ons or down-round bargains.

🪜Next Step → Level-Up

✅Enroll in "Unlocking Startup Wealth: Become Your Own VC By Investing In Pre-IPO Early Stage American Startups Through Investment Crowdfunding (RegCF)"

✅"Unlocking Startup Wealth with The L-C-A System" is a straightforward, 3-step video course, with each of the 6 lessons being a concise 10 minutes, designed to get you from curious to confident investor or issuer quickly. If you want to tap into this overlooked asset class and start investing smartly in America’s most promising startups — this course is for you.

→ Save this PDF and click here—just $97 today.

Disclaimers & Sources

Investment crowdfunding is risky and illiquid; you can lose all invested capital. This material is educational and not investment advice.

Key Sources

Reuters deal announcement (Aug 5 2025) Reuters

HousingWire investor count & total raised (Aug 5 2025) HousingWire

KingsCrowd raise history & $42 m valuation (2020) Kingscrowd

CClear Q3-2025 snapshot for aggregate issuer data (internal).

RegCFRocket - Empowering Main Street, not just Wall Street.

©️ By Yvan De Munck, aka RegCFRocket

My mission: To help 1% of Americans invest at least $1,000 per year for the next 4 years, taking this industry (RegCF) from $3B to $16B by the end of this administration; and scale it to $50B+ by 2035 - all through the power of Investment Crowdfunding. Join me in this mission, and be part of that other 1%.